Disclosure: Some of the links below are affiliate links. Meaning at no additional cost to you, I will earn a commission if you click through and make a purchase. Don’t worry though. I only recommend products that I believe will help you on your journey.

Check Out Related Episodes & Resources

- Please Stop Doing Money Dates

- Why You’re Not Budgeting Even When You Know You Should

- 4 Simple Things You HAVE To Know To Run Your Books Correctly

- Why You Need To STOP Saving For A Rainy Day

- FREE Cash Flow Calculator

Ep. 207: Breaking Free From Mindset & Emotions That Sabotage Your Financial Success

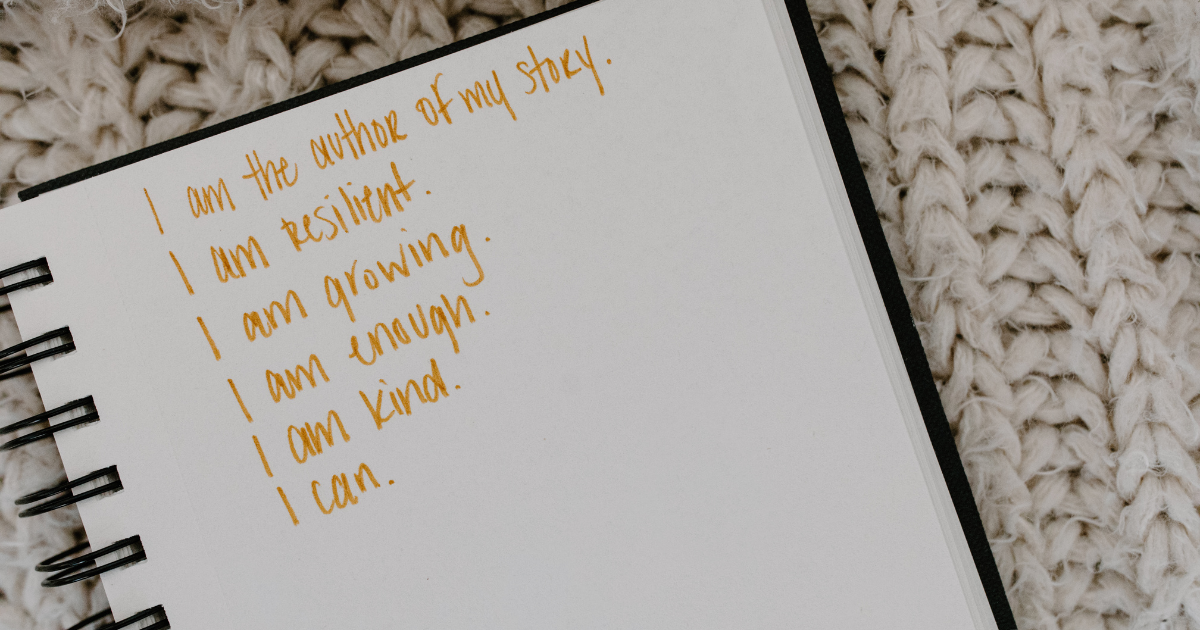

Let’s dive into the hidden mindset patterns that might be sabotaging your finances without you even realizing it. In this first episode of our mini series, we talk about how our beliefs, fears of failure and success, and emotions around money can hold us back more than any budgeting strategy ever could. I share real examples, answer listener questions about detaching self-worth from income, and offer practical steps to start breaking these internal cycles.

If you’ve been feeling stuck, guilty, or frustrated with your progress, you’re in the right place – let’s start building unstoppable financial momentum together, one powerful shift at a time.

LISTEN OR SUBSCRIBE FOR FREE IN YOUR FAVORITE PODCAST APP:

Apple Podcasts | Spotify | Other Podcast Players

Resources:

- 14-Day Money Mastery Action Plan – https://aimeecerka.com/action

- Instagram – https://instagram.com/aimeecerka

Podcast Key Points

- 00:00 – Uncovering Financial Self-Sabotage

- 05:34 – Untying Self-Worth from Success Metrics

- 08:09 – Gratitude’s Impact on Business Mindset

- 10:30 – Breaking Free from Limiting Beliefs

- 14:44 – Financial Support & Transformation Programs

Grab The Cash Flow Calculator

Uncover the right work (that you’re probably already doing) in order to finally see consistent cash flow month after month

Let’s find out in just 90 seconds!

Get started today ????

Fill out your information below to get instant access

Understanding Your Beliefs About Money

What if your biggest financial struggle wasn’t about making more money, but about what you believe about money without even realizing it? This episode is for you if you feel like you should be further along financially or you feel guilty or ashamed when you think about money, or you often think, I’m just not good with money.

So let’s get to it. This is the Your Money, Your Life podcast, the show where I help female entrepreneurs go from stress and struggle to unstoppable. Here we blend step by step strategy, mindset work, and emotional regulation so you can create unstoppable finances, build an unstoppable business, and truly enjoy your unstoppable life.

It’s time to take my wisdom, my expertise to help you simplify money and go beyond the numbers. I’m your host, Aimee Cerka; welcome, and I’m so glad you’re here.

How We Unconsciously Sabotage Our Finances

Welcome to this miniseries on the hidden ways we sabotage our finances and how to finally break free. Over the next few episodes, we’re gonna explore the real reasons money might feel harder than it should, and it’s not just about how much you make or how well you budget.

We’ll look at those silent mindset patterns, the tiny habits that are draining your financial power, and the tactical mistakes that sneak in behind the scenes. My goal is simple: to help you see those patterns without judgment, reclaim your power, and take small, meaningful steps towards unstoppable financial momentum.

Whether you’re feeling stuck, frustrated, or just ready to feel more confident with your money, you are exactly where you need to be. Today, let’s talk about a form of internal sabotage, emotions, and our belief.

The Lid Effect: How Our Money Beliefs Limit Us

So commonly, really, your beliefs. Let’s start there—your beliefs when it comes to finances.

You are not going to exceed past what you believe. Have you heard of the story where, if you put fleas in a jar and you put a lid on it, they’ll jump to get out, but they only could jump as far as the top of the jar?

So they’ll hit the lid repeatedly, but after a little while, you can take the lid off, and the fleas will still only jump to where the lid was because the belief that they’ve created is they can’t exceed that. We don’t even realize we’re stuck here, where we’ve put the lid on ourselves.

Fear of Success and Failure in Wealth Building

We’re gonna talk about that today. Probably the two biggest beliefs that stop us are the fear of success and the fear of failure.

Oftentimes, when we talk about the fear of success, people will be like, you’re crazy, Aimee, I would love to have this amount of money. But then we don’t really show up the way that we need to within our business, or ask for the sales, because there’s a safety there.

If you reach the successful level that you’re talking about, there’s gonna be new challenges that show up. That old saying, “new level, new devil,” really, it’s the same thing—just at the next level of the same tendencies.

You’re just working to continue to improve, and a lot of times they’re the same thing. If you’re more successful, you’re more visible, and there might be more rejection that shows up.

We can also get caught up in the fear of failure. Maybe you’ve done something before that didn’t work out, and you decide you’re never going to do it again. You tried a launch or a budget, and it didn’t work, so you think, that’s just not for me.

The Subconscious Mind and Money Safety

Your subconscious mind does a lot of this for you, and it’s designed to protect you. I’m so thankful that we have that portion to protect us from the lions and bears and all of those things.

But here, we’re actually really safe. It’s not the end of the world—you’re not going to die if you send that sales email.

We have to untangle those fears, those emotions, and those beliefs from our finances and all the areas they affect. For example, someone asked me: how do I untangle my sense of self-worth from immediate business outcomes or income results?

Separating Self-Worth from Money Results

We talked about removing yourself from those results. It’s not about getting instant results exactly the way you want.

Can you hold the belief that your results are coming, even if they haven’t shown up yet? We know the sun’s going to rise tomorrow; you don’t doubt that.

Your results are coming. You’ve done the work. But if your self-worth is tied to that external result, thinking “I’m only successful if I see this result right now,” that’s not how it works. That’s a deep emotional block.

We have to identify where we’ve set this belief on ourselves. Why does this thing have to show up in this exact manner, or it means something about you? It doesn’t mean anything about you.

How Confidence Survives When the Numbers Don’t Add Up

Another question that came up was how to maintain confidence in your business when the numbers aren’t adding up yet. Again, we have to go back to managing our expectations.

Just because something hasn’t shown up yet doesn’t mean that you’re not successful. Where can you shift that—where can you find the success?

With taxes and bookkeeping, if you’ve got guilt and shame tied up because you haven’t hit your income goal yet, and you feel shame because you haven’t, “turned a profit,” remember, there are still a lot of benefits that you have from owning a business.

You’re still successful, and the profit will come. We have to manage those expectations, and those beliefs are huge.

Thankfulness and Growth through Financial Guilt

It’s not just about beliefs and expectations—it’s also about the emotions we tie to them. You can get to a level where you feel guilty about the fact that you haven’t turned a profit, and then you compound it with more guilt, frustration, and shame.

What if you could shift that? What if you could let go of the idea that you’re not good with money or you always struggle with money?

Whatever the guilt is that’s showing up around past financial mistakes, what if you could shift it? You can be thankful for the tax deductions you’ve taken or the information you’ve learned.

How much growth have you had from your business? Isn’t that a form of success?

If you can be grateful now, even before turning a profit, imagine how much better it will feel when you do. Compound those positive emotions instead of beating yourself up.

Quieting the Negative Voice Around Money

Another thing with mindset, especially in the personal development industry—we’ve learned about the power of positive thinking. But sometimes, in the back of your head, there’s a voice saying, “You should know better than this.”

You may know the right thoughts, but your emotional state isn’t matching. That’s what we need to work on, and it’s a skill that takes time.

Someone also asked, “What should I do if I already feel guilty about past spending and debt?” Guilt is a huge topic, and this is where we work on finding gratitude in those expenses because, at the time, you felt it was the right expense for you.

What are the positives there? How can you start releasing that guilt?

Creating Space to Take Action With Your Money

Quick reminder: if you enjoy this conversation but struggle to make space to work on your finances, that’s why I created Execution Lab. It’s the monthly space to check in, ground yourself, and move forward on the money tasks that tend to get pushed aside for just $9 a month.

This is about actually making the space to do it. I’ll put the link in the show notes if you want to check it out.

It’s that quick check-in to encourage you to move forward and make sure you’re prioritizing those things.

Family Money Stories and Breaking Cycles

Another belief we see is rooted in family patterns and dynamics. “My parents were poor, so of course, I had to be poor,” or, “I’m just a stay-at-home mom,” or, “This is just my small business.”

These are identities society has put on us, and they’re not real. But awareness of these patterns is the biggest thing.

We’re not going to fix it immediately. You’ve spent years holding onto these beliefs, so it takes time to shift them.

When we create awareness, we can start asking, “Why do I believe this? Why do I think my last failed launch means the next will also fail?”

Belief, Expectation, and Allowing Success

Why does a past failure mean there can’t be a future success? Why couldn’t someone come to you and want to work with you out of the blue?

We have to hold that belief and sense of possibility. But we can’t get caught up in the expectation that it must happen in a certain way or timeline.

This is where mindset and manifestation can fall short—what if you do everything but it doesn’t show up yet? Does it completely take you out?

Can you hold the belief that it’s going to show up, but if it doesn’t happen in your timeline, you know it’s still coming? Maybe it’s coming at a better time.

You’re still doing your part with mindset, strategy, and emotional alignment. Trust it will show up, and if not, you’ll still be okay.

Managing Expectations and Growth Over Time

Expectations can really take us out, and for me, they used to completely derail me. I’ve just gotten better at managing them.

Think about relationships—how many have suffered due to unmet expectations? Sometimes, even when you communicate, expectations still go unmet.

We have to look at ourselves, our beliefs, and our emotional regulation.

Your Next Step to Break the Financial Sabotage Cycle

So getting clear and being aware is what creates the power. My action step for you today: find where one of these patterns shows up.

Don’t judge yourself. Just notice it—where might you be self-sabotaging your financial success?

Awareness is the first step to reclaiming your personal power. If you’re ready for deeper support, I have two things to mention: Execution Lab—our monthly check-in space for just $9/month—and, if you’re ready for full transformation, the Unstoppable Experience, my high-touch, twelve-month mentorship.

You’ll stop just managing money and start embodying your financial power, creating wealth that supports your values, vision, and vitality.

All the details for both will be in the show notes. Then I’ll see you in the next episode as we continue building unstoppable financial momentum, one powerful shift at a time.

This is a miniseries, so watch for three more episodes about hidden ways we sabotage our finances. That’s it for now. See you next time!

Bonus: Take Control of Your Finances

Thank you so much for listening to the Your Money Your Life podcast. I’ve got a special gift for you – if you’re tired of your finances being a mess, this is for you.

What if you could take charge of your money without feeling overwhelmed, even if you’re not a numbers person or don’t know where to begin?

Take messy action and finally make progress with your finances with the 14-day Money Mastery Action Plan. Use coupon code PODCAST for 40% off—just visit AimeeCerka.com/action and grab your action plan for under $20.

Talk soon.